TN HS-A 2011-2024 free printable template

Show details

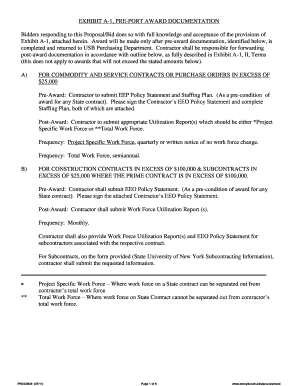

Tennessee Department of Human Services (DHS) Form HS-1965A Revised January 2011 Child and Adult Care Food Program (CA CFP) Application for Participation and Management Plan for Sponsor of Affiliated

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your ein number tn dept form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ein number tn dept form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ein number tn dept online

To use the professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit ein number tn dept. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward.

How to fill out ein number tn dept

To fill out the EIN number TN Dept, follow these steps:

01

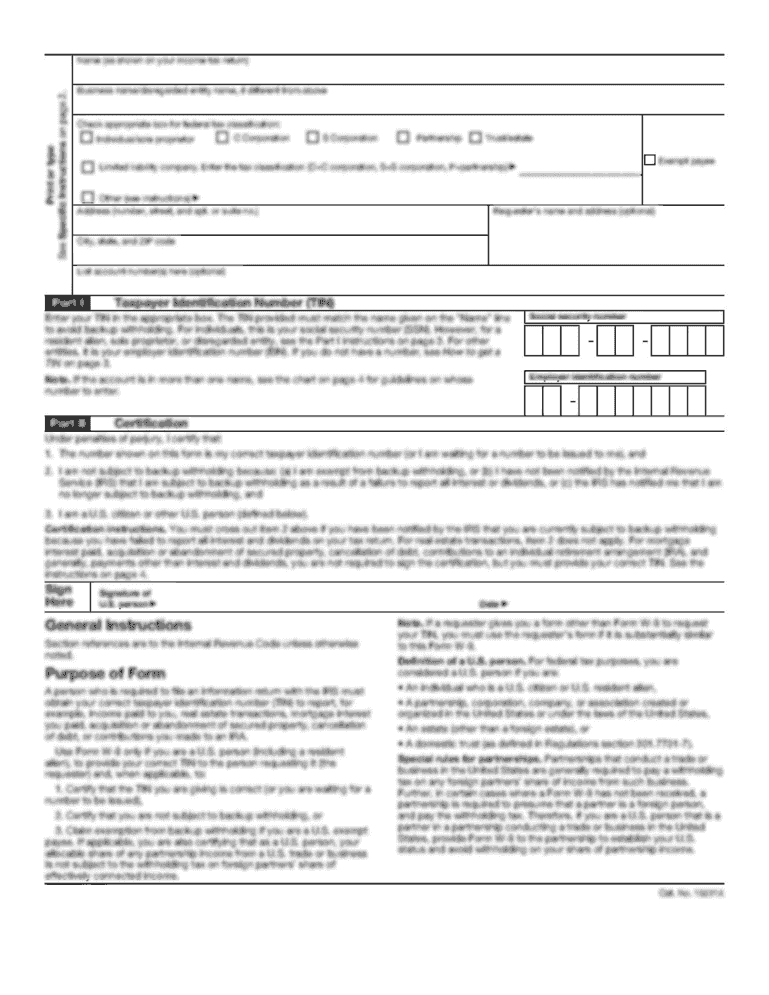

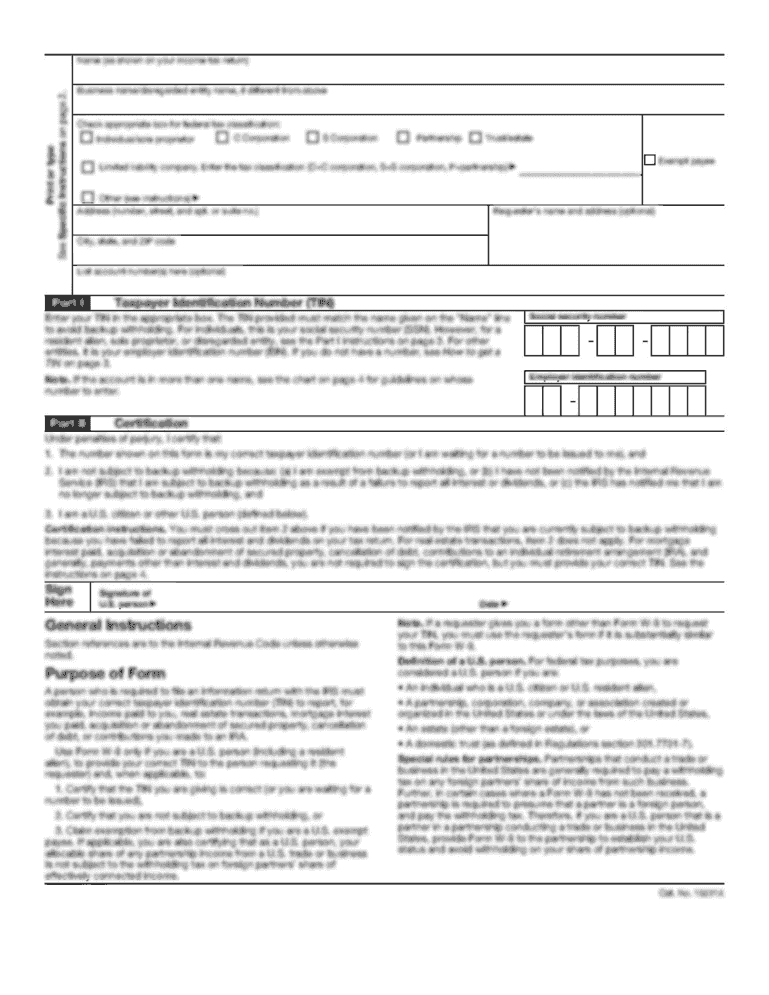

Gather all necessary information: You will need the legal name of your business, its mailing address, and the Social Security Number (or Individual Taxpayer Identification Number) of the responsible party.

02

Access the online application: Visit the official website of the Tennessee Department of Revenue or the IRS website to find the application form for obtaining an EIN number.

03

Provide the required information: Fill out the application form with accurate information. This includes your business name, mailing address, and the responsible party's name and SSN/ITIN.

04

Choose the application method: Decide whether you want to complete the application online or by mail. The online method is generally faster and more convenient.

05

Submit the application: If applying online, review the form and ensure all the information is correct. Then, submit the application electronically. If applying by mail, print the completed form and mail it to the designated address provided on the application instructions.

06

Wait for processing: The processing time depends on the specific department and their workload. Be patient and allow sufficient time for your application to be processed.

Who needs an EIN number TN Dept?

01

Businesses: Any type of business entity operating in Tennessee, such as corporations, partnerships, LLCs, and sole proprietors, usually require an EIN number. This includes both for-profit and nonprofit organizations.

02

Employers: If your business employs workers, has a Keogh plan, or withholds taxes on income other than wages, you generally need an EIN.

03

Trusts, estates, and certain retirement plans: These entities may also require an EIN number for tax reporting purposes.

In summary, anyone operating a business or entity that meets the aforementioned criteria generally needs to obtain an EIN number from the Tennessee Department of Revenue.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ein number tn dept?

The EIN (Employer Identification Number) for the Tennessee Department of Revenue is 62-6001696.

Who is required to file ein number tn dept?

The Tennessee Department of Revenue requires any business that has employees to obtain an Employer Identification Number (EIN), even if the business has no taxable income. This includes sole proprietorships, partnerships, corporations, and non-profit organizations.

How to fill out ein number tn dept?

The EIN number is issued by the Internal Revenue Service (IRS). To obtain an EIN for your business in the state of Tennessee, you will need to complete Form SS-4. This can be done online or by mail. The form requires you to provide information about the business such as the legal name, address, type of business, and owner information. Once you submit the form, the IRS will provide you with an EIN number.

What is the purpose of ein number tn dept?

The purpose of an EIN number (Employer Identification Number) in Tennessee is to identify a business entity for taxation purposes. It is assigned by the Internal Revenue Service (IRS) and is used to report taxes, open a business bank account, and apply for business licenses and permits.

When is the deadline to file ein number tn dept in 2023?

The deadline to file your EIN number with the TN Dept in 2023 has not yet been determined.

What information must be reported on ein number tn dept?

When applying for an Employment Identification Number (EIN) in the state of Tennessee, you will need to provide the following information:

1. Legal name of the entity: This can be either an individual's name (if a sole proprietorship) or the legal name of the organization (if a partnership, corporation, or LLC).

2. Trade name or "doing business as" (DBA) name (if applicable): This is the name under which you conduct business, if different from the legal name.

3. Physical address of the entity: The physical location where your business operates.

4. Mailing address (if different from the physical address): The address where you want to receive any official correspondence from the Department of Revenue.

5. Entity type: The type of organization, such as sole proprietorship, partnership, corporation, or LLC.

6. Principal business activity: A description of the main business or activity conducted by the entity.

7. Start date of business or effective date of the entity: The date when the business started or the entity was created.

8. SSN or Employer Identification Number (EIN) of the responsible party: The Social Security Number (SSN) of the individual responsible for the entity's affairs or the EIN if it is an existing business entity.

9. Reason for applying for an EIN: The reason why you are applying for an EIN, such as starting a new business, hiring employees, or for tax reporting purposes.

10. Owner/Partner/Member information: Names, addresses, and SSNs of all owners, partners, or members (depending on the entity type).

This information is typically required when applying for an EIN with the Tennessee Department of Revenue. It is important to note that the specific requirements may vary, so it is recommended to check with the department or consult their website for additional details or any updates.

What is the penalty for the late filing of ein number tn dept?

The penalty for late filing of an Employer Identification Number (EIN) with the Tennessee Department of Revenue may vary depending on the specific circumstances. It is recommended to contact the TN Department of Revenue directly for the most accurate information regarding penalties and any potential fees associated with late filing.

How can I get ein number tn dept?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific ein number tn dept and other forms. Find the template you want and tweak it with powerful editing tools.

Can I create an electronic signature for signing my ein number tn dept in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your ein number tn dept and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How do I fill out ein number tn dept on an Android device?

Complete ein number tn dept and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

Fill out your ein number tn dept online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.